Your engagement with eyeblack means the world to me. Your support makes it possible.

Writing this meant a lot of esoteric SEC filing searches and combing through buggy government websites in search of an LLC. (Not complaining. High key, I love it. But just illustrating the costs.)

If you’re reading this, you are a free email subscriber or found us online. You’ll be able to read the whole thing as long as you sign up with your email. If you found this story valuable, please consider financially partnering with eyeblack by upgrading to a paid subscription by clicking the upgrade button below:

But, if you ain’t got it, that’s real. You can still help! Share this article, with intent, among friends you believe would love what I’m building. Tell them why you enjoyed this article, why you believe eyeblack is important, and why critical, distinctive and focused sports coverage still matters.

The Baltimore Orioles are finally spenders. Anchored by a $155 million dollar signing of superstar slugger Pete Alonso, Baltimore Sun reporter Jacob Calvin Meyer found the team spent more in free agency this offseason than in the previous seven seasons combined. The Orioles spending spree on supplying a strong roster to support the team’s still-young, talented core. A signal to Baltimore fans that all the pieces matter.

If the Birds soar this year, the new man upstairs made it possible. Principal owner David Rubenstein, who acquired the team in 2024, enables the team to invest substantially more in acquiring outside talent than the previous Angelos family ownership, what Meyer argued was a combination of Rubenstein’s deeper pockets1 and greater desire to win at all costs.

The Orioles’ new owner reaches nine zero wealth through his leadership of The Carlyle Group, a global private equity firm Rubenstein founded and co-chairs. And Carlyle’s riches come in part from its business dealings with the Department of Homeland Security. One is Carlyle’s more-publicized $4.2 billion acquisition of ManTech, an IT and AI service military contractor that has $729 million in contracts with CBP and ICE between 2003-2024.3 But, as eyeblack also identified a link between Carlyle and a Georgia warehouse sale that DHS intends to convert into a migrant jail.

An eyeblack analysis of the Trump administration’s warehouse shopping spree identified a Carlyle-backed shell company listed as the owner of a warehouse that DHS intends to use to house as a processing site that will hold 1400-1600 migrant beds. According to ICE, detainees are expected to stay in processing sites for three to seven days before being placed in a planned mass detention center on their way to eventual deportation.

According to DHS, this model will “incorporate all existing detention standards and will maximize operational efficiency, minimize costs, shorten processing times, and promote the safety, dignity, and respect of all aliens in ICE custody.” ICE’s existing detention standards are nothing to boast about unless the agency takes pride in running what Andrea Pitzer classifies as concentration camps.

But how we do know Carlyle, and thus Rubenstein, is linked to the planned ICE jail? For the Lester Freamons among us, I’ll show some work with passable English and an ugly flow chart.

created by Bradford William Davis | eyeblack

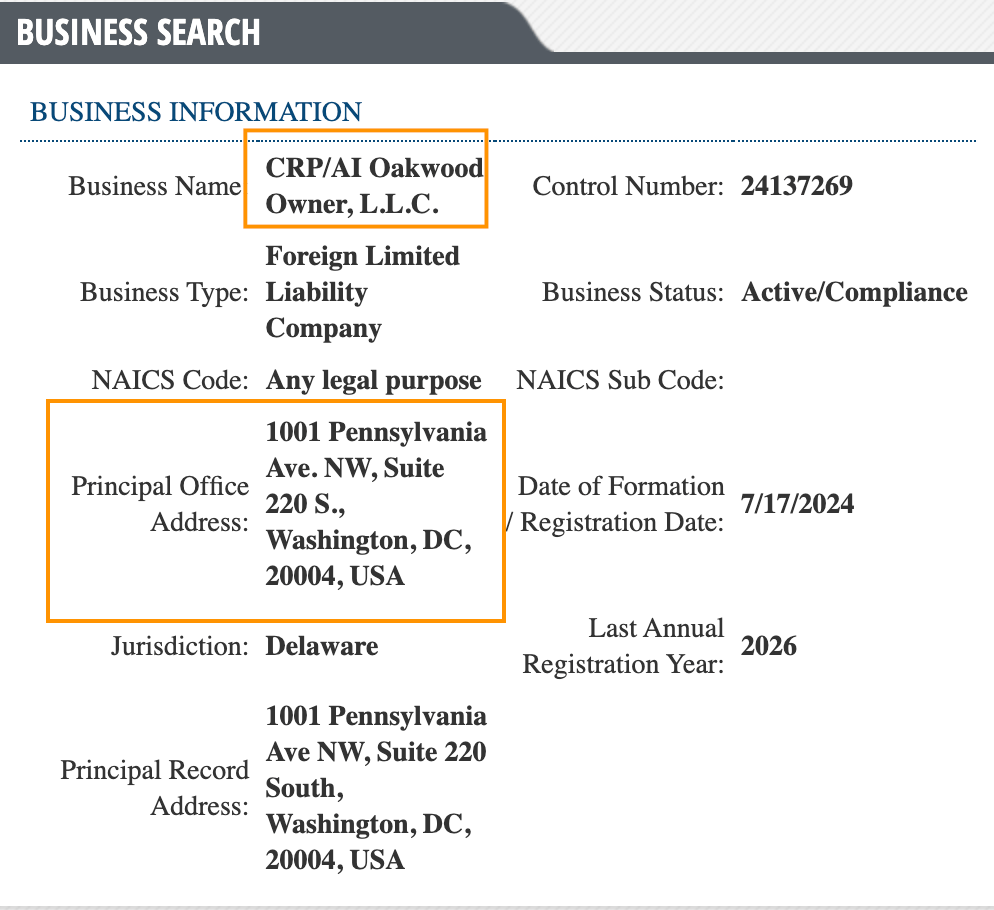

According to property documents, an entity called “CRP/AI Oakwood Owner LLC”2 is listed as the warehouse owners. While the industrial property is in Oakwood, a suburb 40-minutes out Atlanta, documents show that CRP/AI Oakwood Owner shares the same address as Carlyle’s corporate address in Washington DC.

screenshot from Georgia Corporations Department business search

Further, Carlyle’s promotional materials use a CRP acronym in a 2025 press release for Carlyle Realty Partners X (CRP X), a $9 billion “opportunistic real estate fund.” According to Carlyle’s release, CRP X focuses on “attractive supply-demand dynamics” in the industrial real estate sector.4

While the final sale price of the Oakwood warehouse has yet to be confirmed, Project Salt Box’s ICE warehouse database lists three future processing sites with similar planned detention capacity that combined for $238.5 million in sales. Rubenstein is one of three of Carlyle’s controlling partners, and owns a 8.1% stake in the firm5. When Carlyle succeeds, so does Rubenstein.

One moral hazard inherent to the contemporary industrial real estate trade is that DHS, enabled by billions in taxpayer dollars, is an attractive all-cash buyer for your vacant property, so long as you can stomach dabbling in the concentration camp side of the agency’s operations. We have already seen that moral hazard seep into sports. eyeblack identified institutional NBA investor Blue Owl Capital’s concurrent investment in future-ICE mega jails and four NBA teams, including partnering with Marc Lore and baseball superstar Alex Rodriguez to close their 2025 purchase of the Minnesota Timberwolves.

While the talented team competes for championships, DHS has targeted Minneapolis with violent sweeps of immigrants — or anyone an ICE agent presumes to be an immigrant — and the on-camera killings of Renee Good and Alex Pretti. Some of the immigrants DHS arrest in Minnesota will be shipped to detention centers converted from warehouses like the one the Timberwolves part owner just sold. Some of those detainees, presumably, are Wolves fans.

Carlyle did not respond to eyeblack’s repeated requests regarding the formation of the LLC, Rubenstein’s knowledge of the sale, or subsequent conversations around the transaction.6 As a firm managing $440 billion in assets, it remains possible, even probable, that Rubenstein wasn’t aware that his firm sold a building the Trump administration intends to serve as key artery for an Atlanta mega jail.

But what is clear is that just like Rubenstein hopes for his upgraded 2026 Orioles, Carlyle plays to win. At all costs.

1 Rubenstein’s net worth is $3.7b net worth per Forbes estimates.

2 Sourced from Hall County board of assessors.

3 Source: American Friends Service Committee. Probably worth another blog, right?

4 While eyeblack has not confirmed what AI refers to, there is evidence that Carlyle’s LLC is a joint venture is Alliance Industrial, an industrial realty firm with promotional material listing Carlyle as an investment partner. Alliance did not respond to eyeblack’s request for comment in time for publication.

5 Per Carlyle’s latest SEC disclosure.

6 But, two Carlyle communications reps did sign up for eyeblack after reaching out for comment. Thanks!